unemployment insurance tax refund 2021

But what this exclusion means is if you paid taxes on unemployment insurance benefits that you received in 2020 you can get a. File a Report of Change.

Stimulus Check Updates News On Irs Tax Refunds Child Tax Credit California Stimulus Unemployment Benefits Lee Daily

Many filers are able to protect all or a portion of their income tax refunds by applying their.

. 1000 Center Dr Suite 10. After registering with NMDWS you will. The first thing to know is that refunds would only go to taxpayers who received jobless benefits last year and paid taxes on that money before the provision in the American.

IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer. Every employer in Tennessee is required to fill out a Report to Determine Status Application for Employer Number LB-0441. All tax refunds including the 62F refunds are.

Submitting this form will. It sent 1400 stimulus checks into Americans bank accounts it enhanced the Child Tax Credit and it boosted unemployment benefits for a large chunk of 2021. Unfortunately an expected income tax refund is property of the bankruptcy estate.

UNEMPLOYMENT INSURANCE BENEFITS STATE OF NEW JERSEY DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT You will be asked multiple choice questions to confirm your. IR-2021-151 July 13 2021 The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers who overpaid their taxes. View Benefit Charge and Rate Notices.

State law instructs ESD to adjust the flat social tax rate based on the employers rate class. New employers subject to Unemployment Insurance taxes must register with NMDWS on to the Unemployment Insurance Tax Self-Service System. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020.

The flat social tax is capped at 050 for 2021 050 for 2022 075 for 2023 085 for 2024 and. Use the Unemployment Tax and Wage System TWS to. Our team consists of Tax Attorneys.

File a Quarterly Wage Report. The first thing to know is that refunds would only go to taxpayers who received jobless benefits last year and paid taxes on that money before the provision in the American. Tax Return Preparation-Business Tax Return Preparation Tax Attorneys 908 349-1319.

Update Most Unemployment Benefits Won T Be Taxed Irs Will Issue Automatic Refunds Komo

Archive 2021 Kentucky Career Center

How To Get A Refund For Taxes On Unemployment Benefits Solid State

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

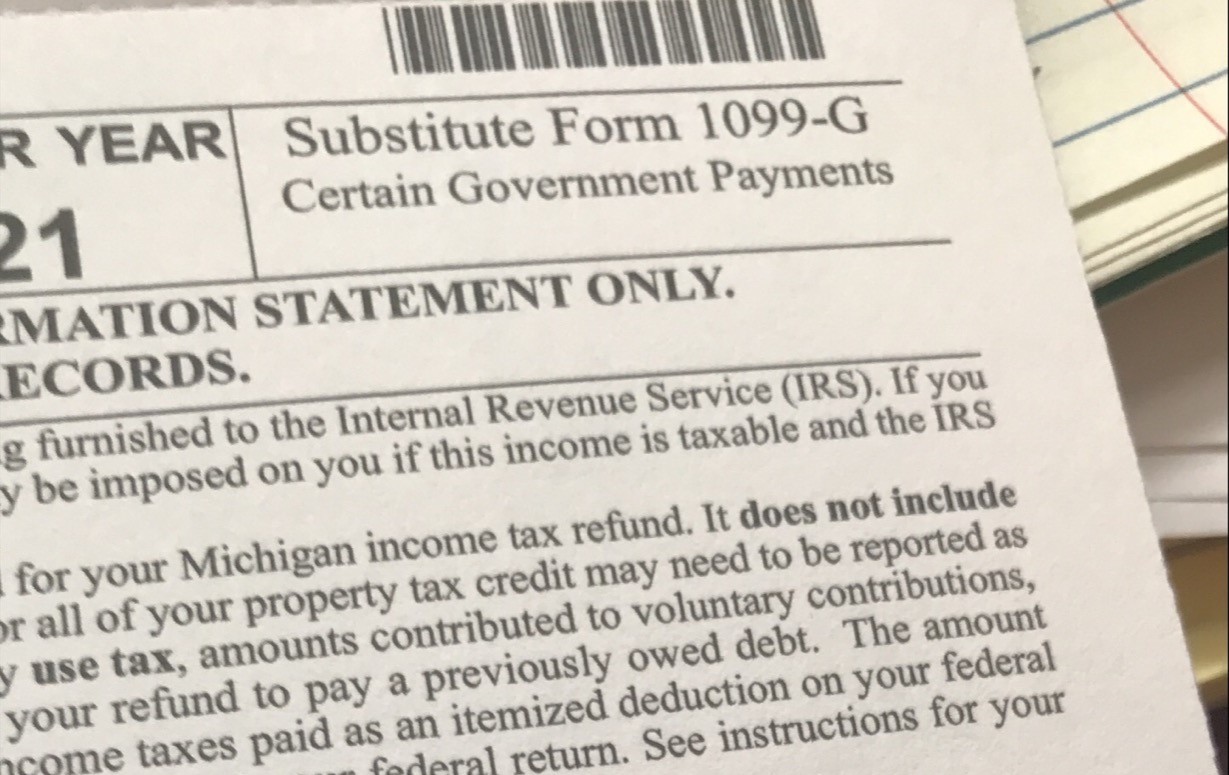

Did You Get Michigan Unemployment Benefits In 2021 Don T File Your Taxes Yet Mlive Com

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

What To Know About Irs Unemployment Refunds

Unemployment Taxes What To Know For The 2021 Tax Year

Dor Unemployment Compensation State Taxes

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Report Unemployment Benefits Income On Your Tax Return

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com

Tax Day 2021 Irs Highlights Key Changes Ahead Of May 17 Filing Deadline

More Irs Refunds Are On The Way How Unemployment Figures In Wfmynews2 Com

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Employee Retention Credit Erc Tax Refunds Sbam Small Business Association Of Michigan

Did You Receive Unemployment Benefits In 2020 The Irs Might Surprise You With A Refund In November

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back